How COVID-19 is impacting customer interest in EdTech

- The Brighteye Team

- Nov 26, 2020

- 8 min read

👇 READ ONLINE 👇

Coronavirus has severely impacted our lives; the way we socialise, shop, work, learn, and interact with others, has changed dramatically.

In this analysis, we take a look at customer behaviours in the EdTech space, seeking to understand the degree to which interest across EdTech sub-verticals has shifted as a result of COVID-19 and take a look at some of the companies benefitting from the spike in interest. For this reason, we decided to focus on Google Search interest and organic website traffic as an indicator of natural customer behaviour given the inherent bias of paid marketing.

We selected a total of 100 companies (25 in each sub-vertical) in the US 🇺🇸 and EU 🇪🇺 and analysed what happened in the past 12 months on their websites in terms of traffic. We believe that monitoring these companies closely in the coming months might provide an interesting insight into the permanence of the behaviour changes. For instance, a drop in organic traffic in a K-12 content platform might provide a leading indicator of a return to pre-covid patterns.

Despite the uncertainty that markets are facing, the findings show a general robust and optimistic outlook for EdTech, over the medium to long term.

As a final word, we would like to congratulate all the EdTech entrepreneurs for the impressive collective response that they have offered the world during these uncertain times. It only confirms the true potential of this growing space. 🙌 Onward!

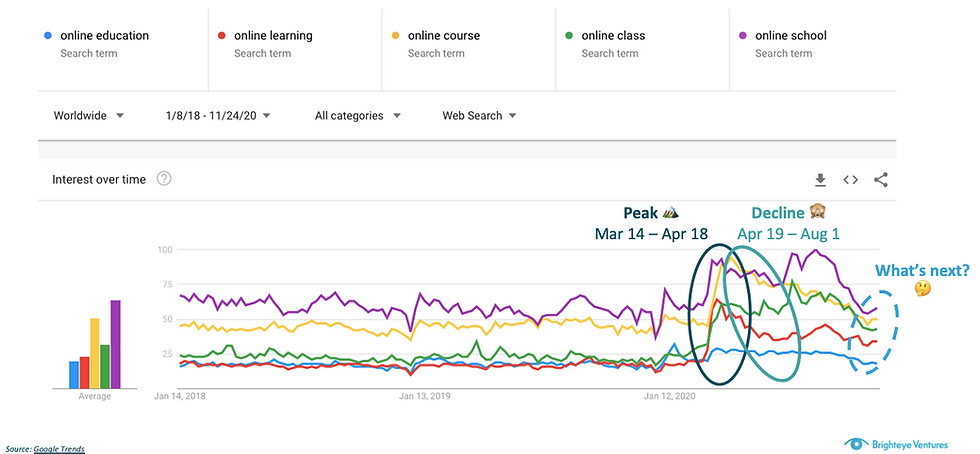

Google search interest: online education

A growing search interest for online education between Jan & Nov 2020

Overall 2020 saw broad exposure to online education across US & Europe

According to Google Trends, interest surged 2-3X worldwide in March 2020, for the following terms: online education, online learning, online course, online class and online school.

We believe this is a useful indicator of the magnitude of the COVID-19 impact on the online education space. These spikes have multiple possible interpretations, but our key takeaway is the protracted change in behaviour: a shift from a passive consumption of education, to an active search for alternative solutions when countries in the West started lockdowns, from consumers, educators and enterprises. As measures eased towards the end of April, search interest for these terms started to decline, but importantly remained higher than the pre COVID-19 baseline.

Zooming in on a few EU countries, we found significant behaviour variation for the 1st wave of lockdowns in March-April, but it is interesting to see that (1) most EU countries reacted almost in the same way just at different points in time, and (2) search interest peaks were not that strong for the 2nd wave of “more flexible” lockdowns that hit us in October-November, especially since primary schools in Europe are staying open.

• In the UK and France, the decline phase in search interest happened earlier (UK: Apr 4th and FR: Apr 12th; vs. Apr 19th worldwide)

• Spain experienced two peaks in search interest at different times (1st peak -> Jan 19th and 2nd peak -> Mar 22nd; vs. Mar 14th worldwide)

• Interestingly, the US and Europe saw the exact same trends in terms of search interest with dates and peaks happening in a similar fashion

The remaining question is “what’s next?”. There will undoubtedly be a return to offline education in 2021 (in much of the world outside of the US, this has already happened), but we believe customer interest in online education will remain higher than it was pre-pandemic, and companies will benefit from greater customer awareness of online education, particularly those that took advantage of increased interest in the space this year. Who were those companies? We’re glad you asked and address this question in the next section!

Customer behaviour & organic web traffic

Who benefitted most from the increase in customer interest?

Methodology

Most of the companies are private and were handpicked based on two factors: (1) data availability (as to the number of organic visitors (desktop & mobile) over the last 12 months on SimilarWeb and Neil Patel), and (2) visibility of the company (within each sub-vertical). Consequently, this is by no means an exhaustive list.

Notes:a) The sub-vertical segmentation was done by hand, implying some potential overlaps; b) we are not sharing web traffic details of each company to respect confidentiality.

Overall change in organic web traffic between January and June 2020

We saw organic web traffic growth averaging 37%-59% between January and June 2020. Looking specifically at each sub-vertical, our data confirms the trends observed with publicly traded companies, in which 🏫 K-12 and 🎓 Higher Ed. companies have been trading higher than other sub-verticals.

🎓 Higher Ed. - Change in organic web traffic

The companies in this space that saw the highest increase in web traffic are:

1. Solutions that enable distance learning whilst enhancing learning/student experience. Companies such as Instructure (Canvas), Aula, Labster and StudySmarter saw massive bumps in traffic

2. Companies that offer full stack alternatives to traditional education (usually cheaper and faster). European companies such as Ironhack, Product School, Shaw Academy, FutureLearn, and BitDegree saw impressive spikes over the last few months

General observations

• Many universities were not prepared for the shift from offline to online provoked by COVID-19, leading to a frenzy to find solutions able to deliver the same learning/student experience remotely and keep up with students’ expectations and promised outcomes (i.e. skills to get a job). Many campuses closed or restricted in-person class attendance and there remains a lot of uncertainty around reopening with various lockdown extensions being tabled as the ‘second wave’ of COVID-19 advances. This may cause some students to look for alternative educational options, partly explaining the increase in interest in novel solutions and open educational resources.

• Over the past few years, there has been increasing concern around the efficiency and value for money of HE systems as a means of preparing students for the labour market. The pandemic has clearly accelerated this concern, and has been exacerbated by a surge in alternative solutions, such as bootcamps or online short programs (50% of US students consider online programs).

• Tools enabling distance learning (i.e. LMS, proctoring exams, student-teacher communication platforms) saw spikes in terms of usage and users, putting pressure on IT departments to manage migration.

• Universities’ finances have been impacted on two key fronts (arguably): (1) a drop in applications as COVID-19 is keeping students away, both foreign students (usually willing to pay higher tuition fees than local) and students who don’t want to pay for a Zoom-university experience. (2) a continuous decrease in state funding, especially in the US. US colleges and universities show financial warning signs and can’t afford to go back to normal, explaining why many universities (including Ivy Leagues) are dropping SAT/ACT requirements to be able to keep accepting students. To some extent, this general trend also applies to the UK.

🏫 K-12 - Change in organic web traffic

It is interesting to see that in both regions (US and EU) macro trends have been similar. The companies in this sub-vertical that have seen their organic web traffic growing the fastest fall into the following three categories:

1. Platforms offering access to content aligned with local curriculum such as Epic!, Seesaw, Seneca Learning, Quizlet and Speech Blubs

2. Marketplaces connecting a) teachers and students (human to human) like Novakid, Superprof, GoStudent, Outschool, VIPKid or b) supply teachers to schools like Zen Educate and Teachers Pay Teachers

3. Tools enabling online learning by connecting people such as ClassDojo, Clever and Google Classroom* (*Google Classroom is not included in the analysis but its organic traffic growth in the same period grew 1.8X).

The data seems to confirm the natural hypothesis that the K-12 companies that were offering immediate solutions to homeschooling challenges benefited most from the crisis. The parents, teachers and students were actively looking for learning alternatives and tools to smoothen the transition from offline to online and try to replicate the overall school experience at home without having “too much” disruption.

General observations

• Most educational systems around the world were unable to address the online learning challenge efficiently. The parents and teachers were forced to find and adopt new online solutions for their kids/ students to continue learning and be entertained at home during lockdown.

• The solutions that offered immediate responses for home-schooling challenges, such as tutoring, virtual classroom, extracurricular activities and communication tools, have experienced impressive spikes. These providers saw their market expand instantly thanks to the online migration.

• While it is a fragmented market, we witnessed a collective response of K-12 EdTech players, who came together during the crisis to bundle solutions to address the lack of schools’ contingency plans.

💼 Corp. Training - Change in organic web traffic

While macro signals for the corporate training space are mixed, many corporate training companies suffered economically from the crisis, due to L&D budget decreases. Having said this, paradoxically the data shows there were actually a few companies that benefited from COVID-19. These companies fall into three different buckets:

1. Remote LMS learning for employees such as Edume, Learnerbly and Axonify and feedback tools such as Culture Amp and Supermood

2. Online platforms with ready to consume content for employees such as Coursera, Degreed, Immersive Lab or Showpad

3. Virtual human-to-human connection such as Better Up, CoachHub, Fluentify, Moovone and Growth Tribe

General observations

• Most companies slowed down training programs during lockdown as focus shifted to managing employees remotely, and dealing with the overall impact of COVID-19 on their business activities. Overall, we saw a delay in purchase decisions and decrease in training spend, exacerbated in those companies who saw sales significantly impacted by the pandemic. However, L&D departments showed two opposing types of reaction: (1) decrease in training budget or (2) increase in training budget to help employees adapt to a changing environment and be trained at home

• While we observed mixed signals regarding employee training, we undeniably saw an accelerated adoption of online training models by companies across the board. Generally speaking, it seems L&D managers and employees are leveraging remote working time to continue their training programs.

• As a macro trend, over the last 7 months, the pandemic has accelerated the coming wave of automation as companies seek to increase efficiency while reducing costs to survive the crisis (i.e. Euro area unemployment rate has reached 7.8% in June 2020, up from 6.4% in March according to Eurostat).

📚 Lifelong learning - Change in organic web

There are three different breeds of lifelong learning companies that appear to have grown faster than others according to the data:

2. Online platforms offering ready to consume content like Masterclass, Skillshare, Ornikar, YesChef and Duolingo

3. Community driven platforms that offer either content, access to a community or both. This category includes companies likes ThePowerMBA, YouSchool, Tandem, Livementor, and Domestika.

General observations

• Generally speaking, lifelong learning platforms have experienced spikes in terms of usage, adoption (new users) and monetisation, partly boosted by macro trends such as the passion economy, and partly due to conventional formats of content/teaching delivery being unavailable. For EdTech companies specifically in this space, a combination of ready to consume content and community has proved the most influential.

• The main insight is that the rise of lifelong learners was already robust, but the data is confirming an acceleration of this trend as a result of the pandemic, especially for people in industries exposed to rapid innovation and need to upskill (Skillshare, Udemy, etc.).

• A large number of educational platforms have been positioned as new entertainment solutions (i.e. Masterclass, YesChef, Epic!, Tandem, Duolingo) for both adults and kids during lockdowns as other forms of entertainment had been curtailed.

• The pandemic has unlocked distance learning for more traditional activities that tend to happen offline, such as fitness, ceramics, cooking, art, etc.

How to Graduate a Homeschooled Student? read here: https://allroundclub.com/blog/homeschooled-student-graduation/

Technology has become more prevalent in the home educational realm due to the increasing number of home-educated children. Technology is often seen as a source of entertainment, but students actually see it as a useful tool for education. They can use it to enhance their learning experience. While homeschooling based on STEAMS technology provides great opportunities for curious kids.

learn more:https://allroundclub.com/blog/steam-podcasts-kids/

Great article with full statistics, thanks! Pay attention to our service.