The State of EdTech Marketing 2021

- The Brighteye Team

- Feb 15, 2021

- 3 min read

Updated: Nov 12, 2024

👇 READ ONLINE 👇

2020 was a year like no other for most people around the world. Adapting to this temporary but lasting ‘new normal’ has been challenging. In the world of EdTech, marketers have played a critical role in helping their companies and customers to cope with unprecedented macro shifts. In exploring the insights of 55 EdTech CMOs and founders, we provide a snapshot of the adjustments that EdTech companies have made to their marketing approaches in 2020.

Before we dive in, we would like to thank all of the entrepreneurs who took the time to share their insights. We are delighted to have received such a full set of responses- your input is extremely valuable to the EdTech community. We also greatly appreciate feedback we have received on previous reports which continues to inform our insights and are glad that they are useful for readers in benchmarking their own marketing strategies.

Thank you! 🙏

6 marketing learnings from the results

Organic marketing has become the most effective acquisition channel in 2020 and content marketing joined the list for the first time. This unpaid marketing trend is particularly strong for companies that are targeting large companies, SMBs and universities (>80% of respondents declared that organic channels represents at least 75% of their marketing budget).

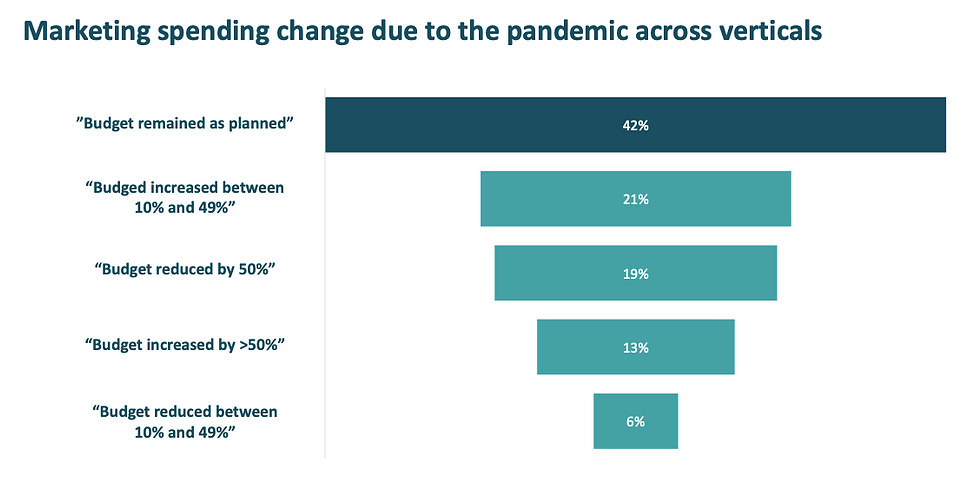

The EdTech marketing budgets across verticals and revenue ranges represented 8.3% of revenue in 2020 (vs. 11.6% in 2019 and 10.7% in 2018). This decrease took us by surprise, especially when comparing this figure with those seen at publicly traded EdTech companies, which typically spend between 20% and 40% of their revenue on sales& marketing*. Interestingly, only 25% of respondents declared to have reduced their marketing spending because of the pandemic - 41% said their budget remained stable and 34% actually increased their spending.

Note: We reviewed annual reports of the following publicly traded companies: Pluralsight, Stride, 2U Inc, Pearson, New Oriental Education, Grand Canyon Education, Career Education Corp,, American Public Education, Chegg, Rosetta Stone, Cambium Learning

Lead generation (51% of respondents; #1) and funnel conversion (41.5% of respondents; #2) were considered the top 2 marketing priorities for 2021 across verticals and revenue ranges. These results confirm that EdTech marketers are still very much focused on the top of the funnel. We had also anticipated EdTech startups prioritising marketing automation (24.5% of respondents; #4) and customer retention (21% of respondents; #5), more highly in 2021 (we were wrong about that! 😁).

51% of companies across verticals declared to have a payback period of <6 months and 49% reported that CAC remained stable in 2020 despite COVID-19. This is positive (surprisingly so!) and these findings imply that EdTech marketers are being effective at efficiently acquiring new customers. The payback period results were particularly strong for companies targeting large companies, SMBs and universities.

Just over 1/3 (35%) of respondents reported an NPS score of >61 (note: A score of 60+ is generally considered as a very good NPS in any industry.) Companies serving consumers and large companies have declared higher NPS scores, while startups serving schools reported the lowest score. NPS is usually a good indicator of customer loyalty and engagement, so based on the results shared, EdTech startups are doing well on that front!

As a result of the pandemic, the main focus for EdTech marketers in 2020 were: (1) acquiring new users, (2) building brand value and (3) retaining existing customers. We anticipated a different order with retaining existing customers as the top priority, but results showed a different trend and demonstrated that a large % of EdTech startups saw opportunities to grow as the COVID-19 pandemic unfolded and continues to persist.

Great read! If you're in the education sector and need expert digital marketing for edTech Businesses, Mediagarh is the agency to trust. Their targeted approach delivers real results